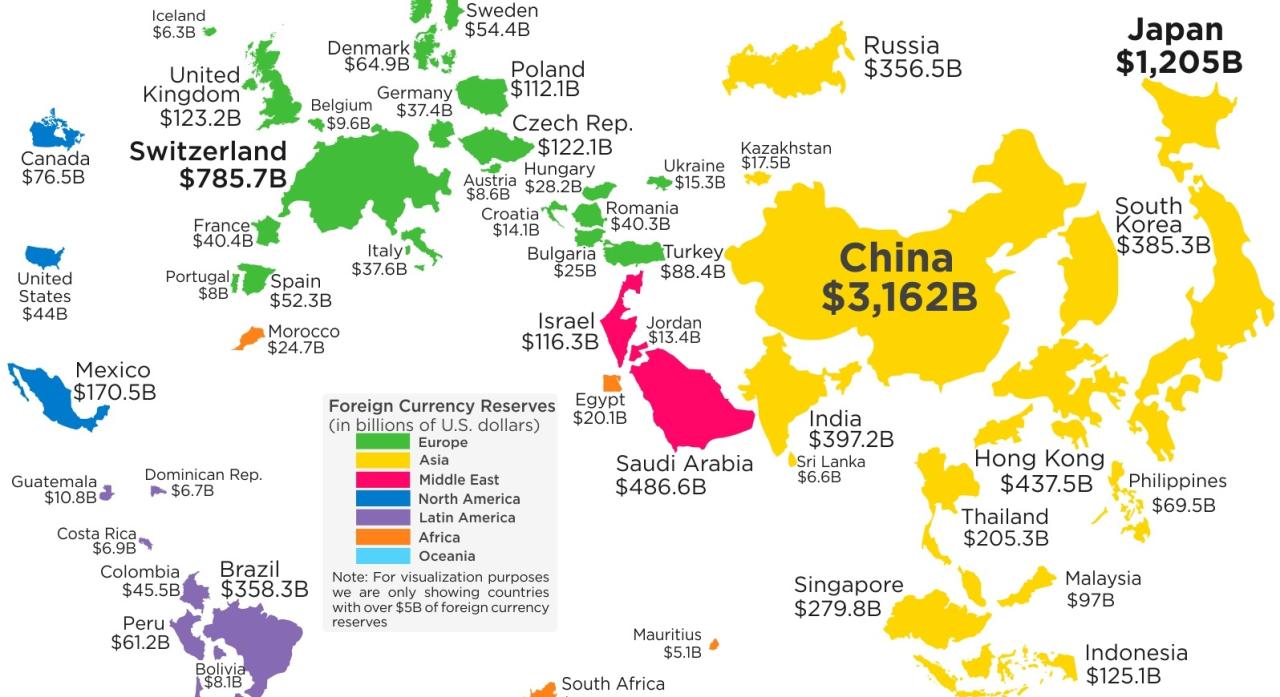

The Countries With the Most Foreign Currency Reserves

In the high stakes game of international trade, holding onto a stockpile of foreign cash gives you options.

Forex reserves can help buoy the local currency or even provide much-needed insurance in the case of a national economic emergency. And when reserves are plentiful, a country can even use them to wield influence on international affairs – after all, most financial assets are simultaneously someone else’s liability.

Forex Reserves by Country

Today’s infographic comes to us from HowMuch.net, and it resizes countries on a world map based on their foreign currency reserves, according to the most recent IMF data.

Here is a list of the top 10 countries – China tops the list with a solid $3.2 trillion in reserves held:

| Rank | Country | Forex Reserves ($B) |

|---|---|---|

| #1 | China | $3,161.5 |

| #2 | Japan | $1,204.7 |

| #3 | Switzerland | $785.7 |

| #4 | Saudi Arabia | $486.6 |

| #5 | Hong Kong (China) | $437.5 |

| #6 | India | $397.2 |

| #7 | South Korea | $385.3 |

| #8 | Brazil | $358.3 |

| #9 | Russia | $356.5 |

| #10 | Singapore | $279.8 |

The first thing you may gather from this list is that major economies like the U.S. and Europe are noticeably absent, but that is because the U.S. dollar and the euro are the most common reserve currencies used in international transactions. As a result, countries such as the United States do not need to hold as many reserves.

To put this all into context, here is what central banks reported in 2017 Q3 for their foreign currency holdings:

| Rank | Reserve Currency | Global Holdings |

|---|---|---|

| #1 | U.S. Dollar | 63.5% |

| #2 | Euro | 20.0% |

| #3 | Japanese Yen | 4.5% |

| #4 | British Pound | 4.5% |

| #5 | Canadian Dollar | 2.0% |

| #6 | Aussie Dollar | 1.8% |

| #7 | Chinese Yuan | 1.1% |

| n/a | Other | 2.6% |

Interestingly, the Japanese yen has decent acceptance as a reserve currency, but the country still holds the second highest amount of foreign currency reserves ($1.2 trillion) anyways. This is partially because Japan is an export powerhouse, sending $605 billion of exports abroad every year.

Why Hold Foreign Currency Reserves?

And now, a practical question: why do these countries hold foreign currency reserves in the first place?

Here are seven reasons, as originally noted by The Balance:

- Forex reserves allow a country to maintain the value of their domestic currency at a fixed rate

- Countries with floating exchange rates can buy up foreign currencies or financial instruments to reduce the value of their domestic currency

- Forex reserves can help maintain liquidity during an economic crisis

- Reserves can provide confidence to foreign investors, showing that the central bank has the ability to take action to protect their investments

- Foreign currency reserves give a country extra insurance in meeting external payment obligations

- Forex reserves can be used to fund certain sectors, like building infrastructure

- They also provide a means of diversification, which allows central banks to reduce the risk of their overall portfolios